The role of profitability and risk

When it comes to the value of a dental practice, there are a few frequent misconceptions.

A practice with high production or high collections is highly valuable. Or, calculating the value is as easy as applying a percentage to collections or applying a multiple. Quite simply, none of these statements are accurate.

What does impact the value of a practice? The simple answer is profitability and risk. Specifically, it’s looking at how profitable has the practice been historically and the defined risk that a buyer would take on today or in the future with the practice, compared to other practices.

If you need to set a practice’s market price, have a formal valuation completed for an upcoming dental transition or if you’re simply wondering what your practice is worth, understanding how profitability and risk work together can provide insight and clarity.

PROFITABILITY

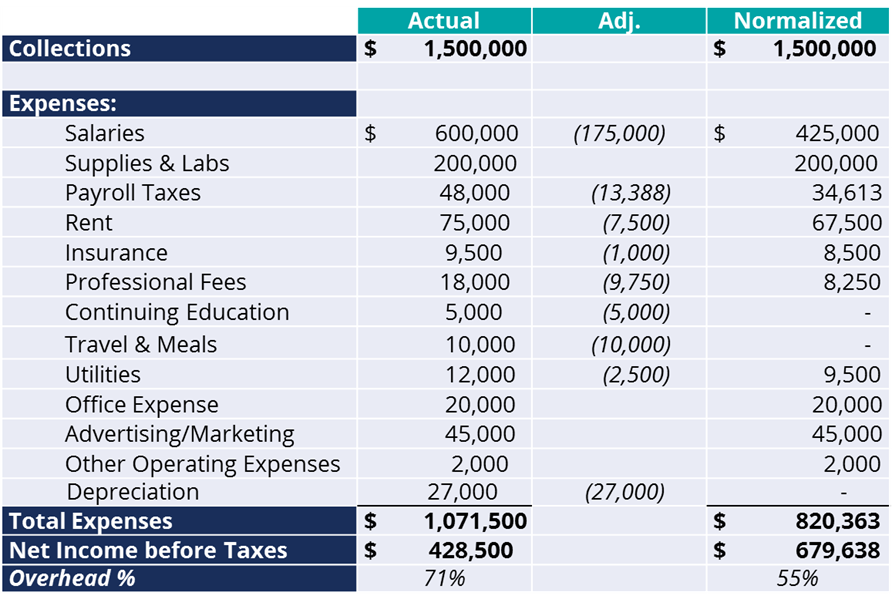

When performing a financial analysis on a practice, profitability is determined using a method called normalization. The goal of normalization is to take the net income as reported on your tax return or profit and loss statement and determine the true profit after adding back personal or discretionary expenses and any W-2 compensation you paid yourself to that net income.

Essentially, the idea is to determine the amount of expense that is truly required to run the dental practice. This allows you to understand the true operating cash flows of the practice and the benefit to you as the owner, historically.

What Discretionary Expenses are Removed or Added?

Before calculating the final net income number, some expenses can be removed (or added) to the bottom line if they are unique or directly related to the current owner and aren’t necessary for the ongoing operations. These are called owner or discretionary expenses.

Common examples of these could be the salary of an overpaid or underpaid family member who works in the practice, or expenses and payments surrounding owning the practice building. Other discretionary expenses can include continuing education, dues and subscriptions, personal taxes, auto expenses, travel or meal expenses, non-recurring or non-cash expenses and other personal expenses.

Once these expenses are adjusted for, you’ll be able to see the true cash flows of the practice. Below is an example of what a normalized profit and loss statement may look like. The “adjustments” column shows the discretionary expenses, while the “normalized” column shows the numbers after the adjusted expenses.

RISK

Risk is what differentiates one practice from another and involves factors that can be both negative and positive. From a financial analysis standpoint, these factors are called subjective risk factors.

TAKE NOTE

Just because a factor has a negative impact, doesn’t mean you should change it for the sake of the practice value. While you may be able to mitigate risk for the value, there are likely reasons why these factors are unique to your practice and what it is today. The important thing is that you understand the various components that go into the analysis.

Examples of Subjective Risk Factors

Here are a few examples of subjective risk factors and how they can have a positive or negative impact on the value.

- Practice Location: Is the practice in an urban or rural location, and how difficult might it be to find a replacement for the doctor production?

- Insurance Mix: Is the practice 100% fee-for-service, PPO or insurance-based, and how might this impact patient flow, reimbursements, etc.?

- Tenure of Staff: Does the practice experience high turnover in staff or does it maintain a seasoned team that can easily run the business?

Other subjective risk factors include patient base (active and new), production ratio, age or condition of equipment, seller’s transition plan, ability to expand, stability of financials and overhead, type of practice, building (leased or owned).

For specialists, additional subjective risk factors may apply, such as the level of contract receivables, case distribution, referral network and distribution, competitors and other specialty-specific factors.

How is Risk Measured?

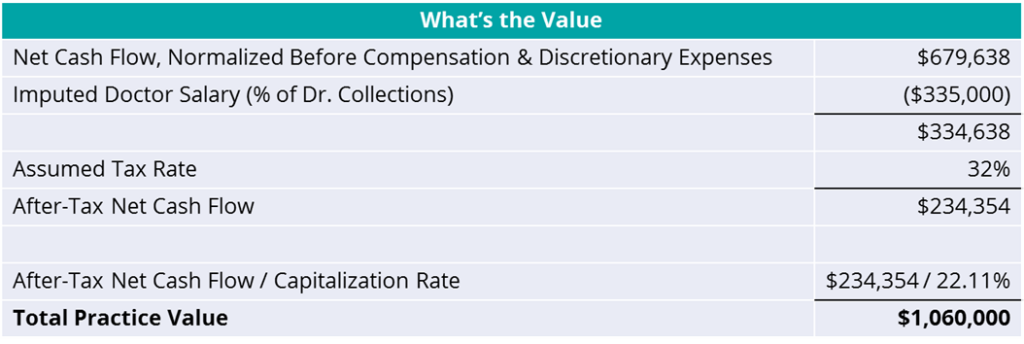

Once the factors are thoroughly analyzed, a subjective risk factor rate will be determined. Then, this rate is incorporated into the capitalization rate via the build-up method. The capitalization rate is applied to the historical profitability to provide the value of that earnings stream. Although this is a complicated calculation typically performed by a certified public accountant or certified valuation analyst, in layman’s terms, you can think about this rate as a rate of return.

DEFINING PRACTICE VALUE USING PROFITABILITY AND RISK

After profitability and risk have been measured, the factors are used to define the final practice value. From a bird’s eye view, the value is determined by dividing the final profitability by the capitalization rate. The full calculation also takes into account the doctor salary and the assumed tax rate.

Providing Clarity

Determining the value of your dental practice is much more than looking at one piece of the overall picture. The process requires a thorough analysis of your practice that considers all factors involved. While the financial pieces can seem overwhelming, NDP can make sense of it all and break the details down for you. Reach out to our team today.